Corporate Governance

- Basic Views

- Basic Views on Corporate Governance

- Initiatives for Sustainability

- Policy on cross-shareholdings

- Reason for election of director candidate

- Independent Outside Directors

- Policy for Constructive Dialogue with Shareholders and Other Investors

- Corporate Governance System

- Overview of Corporate Governance System

- Reasons for Adoption of Current Corporate Governance System

- Incentives

- Director Remuneration

- Main Activities of Outside Officers

- Effectiveness evaluation of the Board of Directors

Basic Views

Basic Views on Corporate Governance

The Company is committed to enhancing its corporate governance in accordance with the following basic concepts from the perspective of helping the Group to achieve sustainable growth and increase its corporate value over the mid to long term. The aim is to implement sound management based on a high level of self-discipline to gain the strong trust of society.

- The Company will create and maintain an environment that secures substantive equality of all shareholders and enables shareholders to properly exercise their rights;

- The Company is primarily engaged in the business of providing individual customers with basic infrastructure services for daily life including energy, telecommunication and CATV, and recognizes that most of these businesses are supported by many stakeholders. In addition, in formulating, implementing and operating business policies, we will conduct business activities from the perspective of compliance while focusing on making a contribution to the local communities;

- The Company will work to ensure the adequate disclosure of company information including non-financial information and transparency in business management in order to establish a foundation for constructive dialogue with stakeholders;

- The Company will, as a holding company, seek to ensure the effectiveness of supervisory functions over the business execution of each group company by the board of directors, formulate mid- to long-term corporate strategies, and strive for sustainable growth and an increase in corporate value; and

- The Company will proactively have dialogues with shareholders and investors with a constructive purpose while explaining and disclosing quantitative financial information and non-financial information in a timely and adequate manner. In this way, we will achieve corporate accountability and strive to meet the expectations of stakeholders including shareholders and investors.

The Group has formulated the “TOKAY-WAY,” the common philosophy of the group, and it is comprised of four layers—the corporate philosophy, mission, vision and value. These are shared with all employees of the group who work to practice them.

Initiatives for Sustainability

The Company describes its sustainability initiatives on its website (https://tokaiholdings.co.jp/english/csr/) and in Supplementary Principle 2-3 (1).

As a sustainability promotion system, we have established the Sustainability Promotion Committee (chaired by the CEO) as an advisory body to the Board of Directors. The committee meets twice a year to take inventory of materiality and issues to be addressed, evaluate the status of efforts to achieve goals, and report to the Board of Directors.

In identifying materiality, including climate change risk, we select candidates based on sectoral materiality maps, etc., published by each ESG research institution, taking into account regional characteristics, industry trends, and other factors. It is evaluated from the two perspectives of "impact on the corporate value of the Group in general" and "impact on society by the Group" and identified through a resolution of the Board of Directors. We also review these materialities on a regular basis, taking into account changes in industry trends and new ESG issues. In addition, regarding human resource development and the improvement of the internal environment, we have introduced and disclosed various measures aimed at ensuring diversity and creating an environment where employees can work with enthusiasm.

Policy on cross-shareholdings

The Group believes that it is vital to build a cooperative relationship with various kinds of corporations for the expansion/sustainable development of its business. From a long term perspective for increase of the Group's corporate value, the Group holds shares required in terms of its strategy comprehensively taking into consideration the importance for the purpose of business strategies and relationship with business partners and other factors.

With respect to the listed shares and other equity that are held pursuant to the preceding paragraph (the “Cross-Shareholding”), the board of directors examines individually and specifically on an annual basis whether the purpose of holding them is appropriate and whether the benefits and risks associated with holding them justify capital cost to verify the appropriateness of holding them. If the verification has found that the holding of any shares is no longer recognized as reasonable, they will be sold to reduce them.

In exercising voting rights on the Cross-Shareholding, the Group will examine the details of the agenda thereof and properly exercise the voting rights after determining whether not it contributed to increase of corporate value of the Group and invested companies. We will not make affirmative determination on any agenda that would impair corporate value irrespective of either company proposal/shareholders proposal.

Reason for election of director candidate

The reasons for selecting director candidates elected at the 11th General Meeting of Shareholders of the Company are as follows.

- Katsuo Oguri has served as President of The Tokai Co., Ltd. and President (CEO) of the Company, and has a wealth of experience and achievements related to the management of the Group, and will contribute to the further development of the Group. We have nominated him again as a candidate for Director as we can expect that he will continue to do so.

- Junichi Yamada is in charge of the Corporate Personnel Planning Department, Personnel Recruitment / Training Office, General Affairs Division Manager, etc., has abundant experience, and is expected to contribute to the further development of the Group.

- Yasuhiro Fukuda has assumed the position of Representative Director of TOKAI Communications Co., Ltd., a Group company of the Company, and has been nominated as a candidate for Director again, as he can be expected to speak from a professional perspective regarding the business of the Group.

- Mitsuhaya Suzuki has assumed the position of Representative Director of TOKAI Cable Network Co., Ltd., a Group company, and has been nominated as a candidate for Director again, as he is expected to speak from a professional perspective regarding the Group's business.

- Mitsugu Hamasaki has assumed the position of Representative Director of The Tokai Co., Ltd., a Group company of the Company, and has been nominated as a candidate for Director as he can be expected to speak from a professional perspective regarding the Group's business.

- Masahiro Sone participates in decision-making from a fair and neutral standpoint, and provides appropriate guidance and advice regarding management. In addition, he has served as Representative Director of Shizuoka Television Co., Ltd., and has a wealth of experience and deep insight regarding company management. If he is elected as an outside director, we expect him to provide advice, etc. for improving corporate value based on his own knowledge regarding management policies and strategies from the perspective of corporate management.

- Masahiro Goto participates in decision-making from a fair and neutral standpoint and provides appropriate guidance and advice regarding management. In addition, he has served as Representative Director of The Shizuoka Bank, Ltd. and Representative Director of a group company of the same bank, and has a wealth of experience and deep insight regarding company management. I have nominated him as an outside director candidate. If he is elected as an outside director, we expect him to provide advice, etc. for improving corporate value based on his own knowledge regarding management policies and strategies from the perspective of corporate management.

- Nobuko Kawashima has never been involved in corporate management other than by serving as an outside director, but she has served as a professor at the Faculty of Economics at Doshisha University and has specialized knowledge. We have determined that he will be able to participate in decision-making from an outside perspective and provide appropriate guidance and advice regarding management, and have therefore nominated him again as an outside director candidate. If she is elected as an outside director, she will provide advice, etc. for improving corporate value based on her own knowledge about her management policy and management strategy from her perspective as a university professor.

- Ryoko Ueda has never been involved in corporate management other than as an outside director, but she has specialized knowledge of corporate governance, ESG, etc. We have selected him as an outside director candidate based on the judgment that he will be able to participate in decision-making and provide appropriate guidance and advice regarding management. If she is elected as an outside director, she will provide advice, etc. for improving corporate value based on her own knowledge about her management policy and management strategy from her expert point of view.

Independent Outside Directors

(Effective Use of Independent Outside Directors)

We have appointed four independent outside directors who meet our independence judgment criteria, and oversee the directors of our company based on their wealth of knowledge and high-level insights on company management, and receive appropriate opinions and advice.

(Criteria for Assessing Independence and Qualification of Independent Outside Directors)

We adopt the same standards as the independence standards established by the Tokyo Stock Exchange.

Policy for Constructive Dialogue with Shareholders and Other Investors

The Company will emphasize the constructive dialogue with shareholders and other investors and make efforts to gain understanding for the Company's management policies through dialogue, as well as listen to the voices of shareholders and other investors, whereby we will absorb and reflect business analysis and views through the eyes of capital providers and other stakeholders and be committed to the Group's sustainable growth and increase of corporate value over mid to long term.

Investor Relations department is in charge of dialogue with shareholders and others.

- Investor Relations department will respond in cooperation with internal divisions to realize a constructive dialogue.

- We implement activities so that shareholders and other investors can develop their understanding of management strategies and business environment of the Company by providing financial results briefings, roundtable discussions with shareholders after general meeting of shareholders, TD-net, information disclosure on the website of the Company and other means.

- Views and other opinions of shareholders and other investors grasped by the Investor Relations department through dialogues have been fed back to directors and other officers and we have shared the recognition of issues.

- The Investor Relations department fully ensures the information control pursuant to the regulations concerning internal information control in order to prevent undisclosed material inside information from being leaked to the outside in connection with the dialogue.

Corporate Governance System

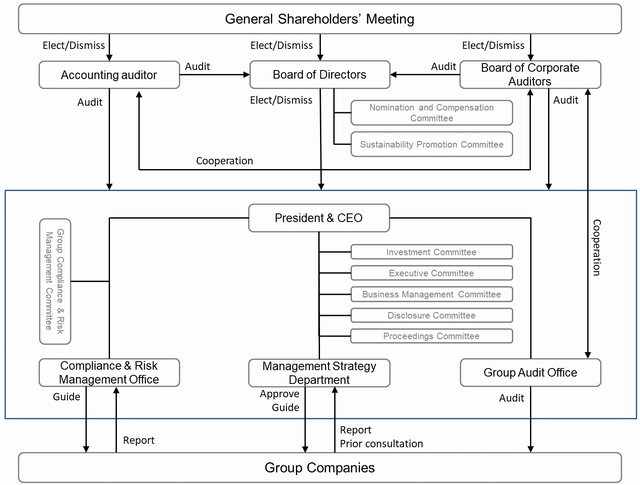

Overview of Corporate Governance System

1.Overview

The Company is committed to enhancing its corporate governance to achieve sustainable growth and increase its corporate value over the mid and long term. The aim is to implement sound management based on a high level of self-discipline to gain the strong trust of society.

Our Board of Directors is composed of up to 10 directors as stipulated in the Articles of Incorporation, of which three are outside directors and the president serves as chairman.

In order to ensure the effective management structure and substantive discussions at the Board of Directors, which are required of the holding company, which is responsible for the Group's business execution management functions, the Group basically maintains an appropriate number of members, while giving due consideration to ensuring diversity and expertise at the Board of Directors.

The three Outside Directors are Independent Outside Directors and Outside Audit & Supervisory Board Members appointed in accordance with the independence standards stipulated by the Tokyo Stock Exchange.

We are a company with an Audit & Supervisory Board, and we have four Audit & Supervisory Board Members, including three outside Audit & Supervisory Board Members. The full-time Audit & Supervisory Board Members serve as the chairperson of the Audit & Supervisory Board.

The Board of Corporate Auditors meets once a month to receive reports on important matters related to audits and to discuss or make resolutions.

The Board of Directors audits the execution of duties by directors through participation in major meetings such as the Board of Directors and operational and accounting audits.

The Board of Corporate Auditors regularly convenes outside directors to strengthen cooperation with outside directors and exchange information.

The Nomination and Compensation Committee strengthens the independence, objectivity and accountability of the functions of the Board of Directors by ensuring the transparency and objectivity of the nomination of directors, evaluation of compensation, etc., and the decision-making process. It has been established for the purpose of further enhancing the corporate governance system.

The Sustainability Promotion Committee evaluates and verifies the status of efforts to achieve the goals of materiality (important issues) in order to promote the sustainability of the Group.

The Investment Review Committee deliberates on capital investment projects, M&A, orders, etc., the Executive Committee deliberates in advance the agenda of the Board of Directors meetings of the Company and Group companies, and reports on the progress of projects being promoted by the Company and Group companies. The Business Management Committee deliberates on issues and solutions for understanding the business progress of major Group companies and achieving management targets. The Disclosure Review Committee deliberates on the appropriateness of content when submitting securities reports and quarterly reports, and the Litigation Review Committee deliberates on important lawsuits.

We also hold regular meetings with outside directors (four times), accounting auditors (three times), internal audit departments (two times), full-time auditors of each Group company (four times), our compliance department (two times), and compliance officers of each Group company (12 times) in an effort to enhance audits and improve their effectiveness.

We have established the Group Compliance and Risk Management Committee to share information on deficiencies in the internal controls of each Group company, as well as reports and preventive measures for major complaints and accidents, to promote compliance training throughout the year and improve internal controls.

2.Audit

Each of our Group companies has adopted a corporate auditor system, and the Board of Corporate Auditors is composed of three to five corporate auditors (including one full-time corporate auditor and more than half of external corporate auditors) at major Group companies. The Board of Corporate Auditors audits the execution of duties by directors by participating in important meetings of the Board of Directors and other bodies and conducting operational and accounting audits.

The Company's full-time auditors conduct audits of the Company based on the audit plan, and report and share information at regular meetings (held twice) with the representative director. In addition, regular meetings are held with outside directors (held four times), accounting auditors (held three times), internal audit departments (held twice), full-time corporate auditors of each group company (held four times), and the Company's compliance department (held four times). (implemented twice), and with the compliance officers of each group company (implemented 12 times), we are striving to enhance audits and improve their effectiveness.

Reasons for Adoption of Current Corporate Governance System

With energy business, CATV, and ISP business as the core, we are developing various businesses for 3.3 million consumer customers and corporate customers.

Each group company strives to realize the Group's management policy and achieve its goals, such as expanding business and enhancing customer service, through transactions in close proximity to customers.

By dispatching directors to each group company, we are working to improve governance through each company's board of directors. In addition, by having the representatives of major group companies concurrently serve as part-time directors of the Company, we are working to quickly absorb opinions from group companies and unify the intentions of the group.

In addition, the Company has appointed four outside directors and four outside corporate auditors. Outside directors participate in decision-making from a fair and neutral standpoint and provide appropriate advice and guidance regarding management. Since then, they have been monitoring, making proposals, and giving advice to the directors, and are fully working to strengthen the management supervision function.

| Number of board members | Number of Audit & Supervisory Board members |

||

|---|---|---|---|

| Total | Of which, outside directors |

Total | Of which, outside auditors |

| 9 | 4 | 5 | 4 |

Incentives

| Incentive Policies for Directors | Performance-linked Remuneration |

|---|

The Company aims to improve mid- and long-term business performance and increase motivation to contribute to the improvement of corporate value by further clarifying the link between the business performance/share value of the Company and the compensation of directors, executive officers and other board members of the Company and directors and other board members of some subsidiaries of the Company ("officers," excluding outside directors). The Company also does this by having directors share risks of share value deterioration as well as benefit of share value increase, a new stock-based compensation system (BBT = Board Benefit Trust) will be introduced to provide stock-based compensation to officers. The system assigns a certain number of points for three business years including the current business year and provides shares of the Company corresponding to the determined number of points after the applicable officer resigns.

| Recipients of Stock Options | Employees, Subsidiary Directors, Subsidiary Employees |

|---|

As part of the 10th anniversary celebration of the TOKAI Group becoming a holding company, employees of the Company and directors and employees of the Company's subsidiaries will hold a meeting in October 2021 for the purpose of raising their motivation and morale for improving the Group's performance and increasing corporate value. Granted monthly stock options.

Director Remuneration

| Disclosure of Individual Directors' Remuneration | We do not disclose individual remuneration |

|---|

The amounts of compensation for directors and corporate auditors in FY2022 were as below:

106 million yen for four directors

26 million yen for a corporate auditor

40 million yen for six outside directors and auditors

(Note)

- In addition to the above, there are two unpaid directors. These two directors also serve as officers of the subsidiary, and the total amount of remuneration received from the subsidiary as officers is 72 million yen.

- At the conclusion of the 1st Ordinary General Meeting of Shareholders held on June 28, 2012, the Company abolished the retirement benefits system for directors and corporate auditors. has resolved to present each director with a retirement bonus corresponding to the term of office until the retirement bonus system is abolished.

| Policy on Determining Remuneration Amounts and Calculation Methods | Established |

|---|

The basic policy for the remuneration of our directors was to establish a remuneration system that appropriately reflects our responsibilities and the degree of contribution to our business, within the limits of remuneration determined by the general meeting of shareholders, taking into account the management, economic conditions, individual evaluation results of directors, balance with employee salaries, etc., and the policy was adopted after deliberation and decision of the policy at the Board of Directors meeting held on February 18, 2021.

Outline of the decision policy

Directors' remuneration consists of fixed remuneration (monthly remuneration) and stock remuneration consisting of bonuses and non-monetary remuneration. Provided, however, that no non-monetary share compensation shall be paid to an Outside Director in light of his/her duties.

Main Activities of Outside Officers (FY2022)

Outside Directors

Outside Auditors

Masahiro Sone

Masahiro Goto

Nobuko Kawashima

Kenji Tateishi

Jiro Amagai

Yoshio Ito

1) Attendance to the Board of Directors Meetings

12/12

(100.0%)

12/12

(100.0%)

12/12

(100.0%)

11/12

(91.7%)

12/12

(100.0%)

12/12

(91.7%)

2) Attendance to the Board of Auditors Meetings

10/11

(90.9%)

11/11

(100.0%)

10/11

(90.9%)

3)Remarks at the Directors and Auditors meetings

Taking advantage of his wealth of experience and high insights on company management, he participated in decision-making from a fair and neutral standpoint, and provided appropriate advice and guidance on management.

Taking advantage of his wealth of experience and high insights on company management, he participated in decision-making from a fair and neutral standpoint, and provided appropriate advice and guidance on management.

Utilizing the specialized knowledge cultivated as a university professor, he participates in decision-making from a fair and neutral standpoint, and based on his own knowledge, provides appropriate advice and guidance for improving corporate value regarding management policies and strategies.

Taking advantage of legal knowledge and broad insights cultivated as judges and lawyers, has monitored, proposed, and advised directors from a fair and neutral position.

Taking advantage of his wealth of experience and high insights in company management, has monitored, proposed and advised directors from a fair and neutral position.

Taking advantage of his wealth of experience and high insights in company management, has monitored, proposed and advised directors from a fair and neutral position.

In addition to the number of meetings of the Board of Directors mentioned above, there was one written resolution deemed to have been made by the Board of Directors pursuant to Article 370 of the Companies Act and Article 30 of the Articles of Incorporation of the Company.

Each outside director regularly attends meetings of the Board of Corporate Auditors in order to strengthen cooperation with the Board of Corporate Auditors and exchange information.

Effectiveness evaluation of the Board of Directors

| Outside Directors | Outside Auditors | |||||

|---|---|---|---|---|---|---|

| Masahiro Sone | Masahiro Goto | Nobuko Kawashima | Kenji Tateishi | Jiro Amagai | Yoshio Ito | |

| 1) Attendance to the Board of Directors Meetings | 12/12 (100.0%) |

12/12 (100.0%) |

12/12 (100.0%) |

11/12 (91.7%) |

12/12 (100.0%) |

12/12 (91.7%) |

| 2) Attendance to the Board of Auditors Meetings | 10/11 (90.9%) |

11/11 (100.0%) |

10/11 (90.9%) |

|||

| 3)Remarks at the Directors and Auditors meetings | Taking advantage of his wealth of experience and high insights on company management, he participated in decision-making from a fair and neutral standpoint, and provided appropriate advice and guidance on management. | Taking advantage of his wealth of experience and high insights on company management, he participated in decision-making from a fair and neutral standpoint, and provided appropriate advice and guidance on management. | Utilizing the specialized knowledge cultivated as a university professor, he participates in decision-making from a fair and neutral standpoint, and based on his own knowledge, provides appropriate advice and guidance for improving corporate value regarding management policies and strategies. | Taking advantage of legal knowledge and broad insights cultivated as judges and lawyers, has monitored, proposed, and advised directors from a fair and neutral position. | Taking advantage of his wealth of experience and high insights in company management, has monitored, proposed and advised directors from a fair and neutral position. | Taking advantage of his wealth of experience and high insights in company management, has monitored, proposed and advised directors from a fair and neutral position. |

In addition to the number of meetings of the Board of Directors mentioned above, there was one written resolution deemed to have been made by the Board of Directors pursuant to Article 370 of the Companies Act and Article 30 of the Articles of Incorporation of the Company.

Each outside director regularly attends meetings of the Board of Corporate Auditors in order to strengthen cooperation with the Board of Corporate Auditors and exchange information.

In order to analyze and evaluate the effectiveness of the Board of Directors as a whole, the Board of Directors conducts self-evaluations by each Director and Audit & Supervisory Board Member.

Based on the self-evaluation conducted in April 2023 with the involvement and advice of a third-party organization, as a result of discussions at the Board of Directors, the operation and effectiveness of the Board of Directors in fiscal 2022 will be effective. We analyzed and evaluated that there were active discussions on various management issues such as policy, capital investment, corporate governance, and business execution.

In addition, in this self-evaluation, there were issues such as the prompt provision of materials for the Board of Directors and the further enhancement of the governance system, including subsidiaries.

The Board of Directors will continue to discuss these issues and improve their effectiveness in order to further strengthen the Board's supervisory functions.

Internal Control System

Based on the Companies Act and the Enforcement Regulations of the Companies Act, the Board of Directors has resolved as follows about the Internal Control system to ensure the appropriateness of operations in a company group consisting of the Company and its subsidiaries (hereinafter referred to as the Company Group).

- The system to ensure that directors, executive officers and employees of the Group exercise their duties in accordance with law and the articles of incorporation:

- Matters regarding storage and management of information on the execution of duties by directors and executive officers of the Group

- Regulations and other systems regarding the Group's management of risks of loss

- Systems to ensure the efficient and proper execution of duties by directors and executive officers of the Group

- Matters regarding applicable employees in the case that corporate auditors request employees to be assigned to them to assist them in their duties, and matters regarding the independence of those employees from directors

- Systems for reporting to corporate auditors by directors, executive officers and employees of the Group, and other systems regarding reporting to corporate auditors

- Other systems to ensure effective audit by corporate auditors

Status of Compliance with the Japan's Corporate Governance Code

The Company implement all the principles established in the Corporate Governance Code.

Other

Adoption of Anti-Takeover Measures

We have not adopted Anti-Takeover Measures.

TOKAI Holdings Corporation Basic Policy on Corporate Governance and Corporate Governance Report

TOKAI Holdings Corporation Basic Policy on Corporate Governance [![]() 71KB]

71KB]

Corporate Governance Report / Last Update : July, 14, 2023[![]() 303KB]

303KB]