Information Disclosure Based on TCFD Recommendations

Information Disclosure Based on TCFD Recommendations 2024

The TOKAI Group has been actively working towards solving various challenges faced by society. In December 2021, the TOKAI Group formulated the "Sustainability Declaration" and set goals to address identified material issues by 2030. Among them, achieving carbon neutrality by 2050 and addressing climate change are important themes closely related to the energy provided by our group, which are social issues that require global efforts.

The TOKAI Group believes that identifying and implementing measures to address climate change risks and opportunities using the TCFD framework and integrating them into our business strategy contribute to the sustainable growth and enhancement of corporate value.

In the fiscal year 2022, we disclosed information in accordance with the TCFD guidelines for the first time. Moving forward, we will enhance the resilience of the TOKAI Group to climate change issues through scenario analysis, review the content annually, and strive to improve information disclosure, contributing to the realization of a sustainable society.

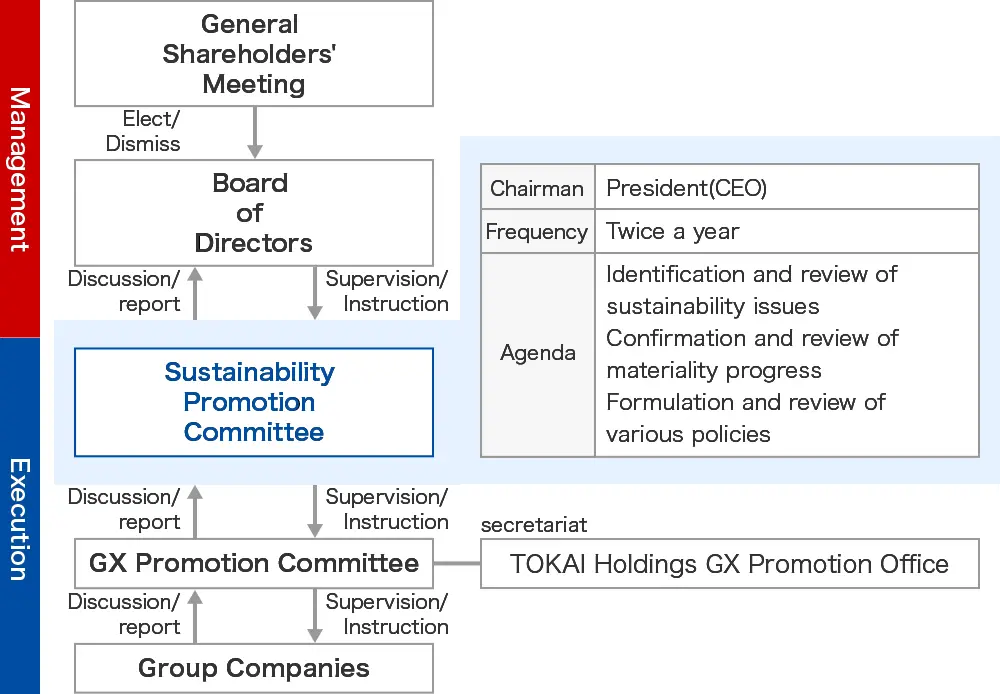

1.Governance

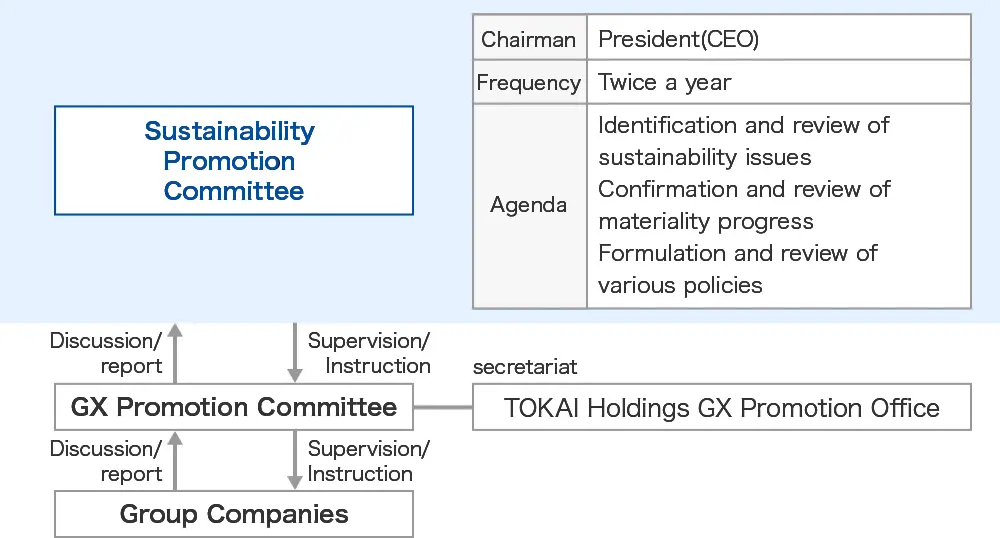

The TOKAI Group aims to actively engage in social issues, including climate change, and contribute to the realization of a sustainable society. To promote management with a sustainability perspective, the "Sustainability Promotion Committee" serves as one of the advisory bodies to the Board of Directors. The "Sustainability Promotion Committee" is chaired by the President and CEO and consists of responsible officers from departments such as management and risk management, presidents of group companies, and external directors who provide advice from an objective standpoint.

The committee meets twice a year, to take stock of material issues and action assignments and to assess the status of initiatives for the achievement of targets. Climate-related initiatives and issues discussed at the Sustainability Promotion Committee are reported to the Board of Directors, and under the appropriate management and supervision of TOKAI Group's top management, they are instructed to the Group companies through the GX Promotion Committee which is comprised of Group companies.

2.Strategy

(1) Assumptions and Coverage of Scenario Analysis

Time Axes

As time axes, given that 2050 is when we aim to achieve carbon neutrality, we defined the period to the end of 2025 (TOKAI Group Medium-Term Management Plan 2025) as the short term, the period to 2030 as medium-term (milestone on the path to 2050), and the period to 2050 as long-term. In addition, we assessed the financial impact as of 2030.

| Short term | The end of 2025 (TOKAI Group Medium-Term Management Plan 2025) |

|---|---|

| Medium-Term | 2030 as medium-term (milestone on the path to 2050) |

| Long-term | 2050 |

Target Business

The coverage of the analysis was the Group's five businesses that are of particular importance as well as its operating companies, which together account for 98% of Group net sales (fiscal 2022). In particular, the Group's core energy business is a business domain in which major changes in the business environment are likely as part of the planned transition to decarbonization and we recognize the importance of assessing the scale of the impact in advance.

| Energy business | TOKAI CORPORATION, TOKAI GAS CORPORATION |

|---|---|

| Information and Communications business | TOKAI Communications Corporation |

| CATV business | TOKAI Cable Network Corporation and 10 subsidiaries ICHIHARA CABLE TELEVISION CORPORATION, ATSUGI ISEHARA CABLE NETWORK CORPORATION, LCV CORPORATION, KURASHIKI CABLE TELEVISION Inc, Toco Channel Shizuoka Corporation, Net Technology Shizuoka Co.,Ltd., Tokyo Bay Network Co.,Ltd., Cable Television Tsuyama Co., Ltd., SENDAI CATV Co., Ltd., Okinawa Cable Network Inc., |

| Construction, Equipment, and Real Estate business | TOKAI CORPORATION, TOKAI GAS CORPORATION |

| Aqua business | TOKAI CORPORATION |

Scenario

To analyze the risks and opportunities, and financial impact of climate change, the Group conducted analyses for two scenarios: the 1.5℃ scenario and the 4℃ scenario, and we considered measures to be taken for both scenarios.

| 1.5℃ scenario | 4℃ scenario | |

|---|---|---|

| Worldview |

Goal proposed in the 2015 Paris Agreement.

|

Scenario which assumes inadequate progress on climate action and continually growing GHG emissions, causing average global temperatures to rise as much as 4℃ above pre-industrial levels by 2100, and leading to more widespread and severe physical damage, including typhoons and flooding

|

| Carbon tax | 140$/t-CO2 (IEA: World Energy Outlook2023) | 42$/t-CO2 (IEA: World Energy Outlook2023) |

Based on our analysis conducted for the two scenarios described above, the main risks and opportunities, the impact on the Group, and measures to be taken to address them are as follows.

(2) Results of Scenario Analysis

We conducted scenario analysis to understand the impact on the Group's businesses, taking into consideration external scenarios and our own unique circumstances. We verified the degree of importance of transition risks, physical risks and opportunities in terms of "likelihood*1" (on a scale of 1 to 3) and "magnitude of impact*2" (on a scale of 1 to 3) and classified them into three levels (minor, moderate and major) based on the matrix shown on the right.

- *1Likelihood of occurrence is classified on a scale of 1 to 3, where 1 is low, 2 is medium and 3 is high.

- *2Where the financial impact can be quantitatively assessed, the impact on ordinary profit is estimated and classified on a scale of 1 to 3, where 3 is an impact exceeding ±5 billion yen, 2 is an impact exceeding ±1 billion yen, and 1 is an impact of ±1 billion or less.

- 1.5℃ scenario

The introduction and strengthening of carbon taxation is likely to result in taxation on our own GHG (Scopes 1 and 2) emissions and higher procurement costs on the LP gas business and city gas business. There is also the possibility that demand for gas will fall in response to the regulation of GHG emissions, changes in the energy mix and other developments.

Meanwhile, more widespread use of energy-saving equipment will likely have an impact both in terms of the risk of decline in gas usage and greater opportunities to sell energy efficiency equipment, etc. More opportunities to sell thermal insulation, ZEH, etc. amid growing awareness of the thermal insulation performance of houses are also expected. - 4℃ scenario

More severe natural disaster including higher seas levels as a result of extreme weather events and typhoons will likely affect our facilities (energy supply facilities, data centers , communication equipment, etc.), supply chains and customers, bringing business activities to a halt.

However, we expect to see high demand for the Aqua home-delivery service amid rising average temperatures and heat waves, and growing demand for IT services including managing risk in the cloud to avoid the loss of data stored on-premises due to flooding, etc.

Demand for CATV, which offers community channels as a means of communicating local information about increasingly frequent natural disasters, is also likely to increase.

| Risk/ Opportunity |

Category | Factor | Target Business |

Impact on TOKAI group | Time axes | Financial impact in 2030 |

TOKAI group's countermeasure | ||

|---|---|---|---|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||||||

| Risks | Transition | Policies/ Legal Regulations |

Introduction of carbon tax |

Company-wide |

|

Medium to long term | moderate | minor |

|

| Energy sector |

|

Medium to long term | major | moderate |

|

||||

| Changes in energy policy |

|

Medium to long term | major | minor | |||||

| Technologies | Expansion of energy-saving equipment |

|

Short term to long term | moderate | minor | ||||

| Reputation | Increasing low-carbon and decarbonization orientation | Company-wide |

|

Medium to long term | major | minor |

|

||

| Phisical | Acute | Increase in natural disasters |

|

Short term to long term | moderate | moderate |

|

||

| Chronic | Changes in the global environment and social structure, etc. | Energy Sector |

|

Short term to long term | moderate | moderate |

|

||

| Opportunities | Policies | Policy to promote the spread of energy-saving equipment |

|

Short term to long term | major | minor |

|

||

| Market | Increase in natural disasters | Telecommunica-tions sector |

|

Short term to long term | minor | moderate |

|

||

| CATV Sector |

|

Short term to long term | minor | moderate |

|

||||

| Chronic temperature rise | Aqua Sector |

|

Short term to long term | minor | moderate |

|

|||

| Reputation | Growing Scoal interest in ESG investing | Company-wide |

|

Short term to long term | moderate | minor |

|

||

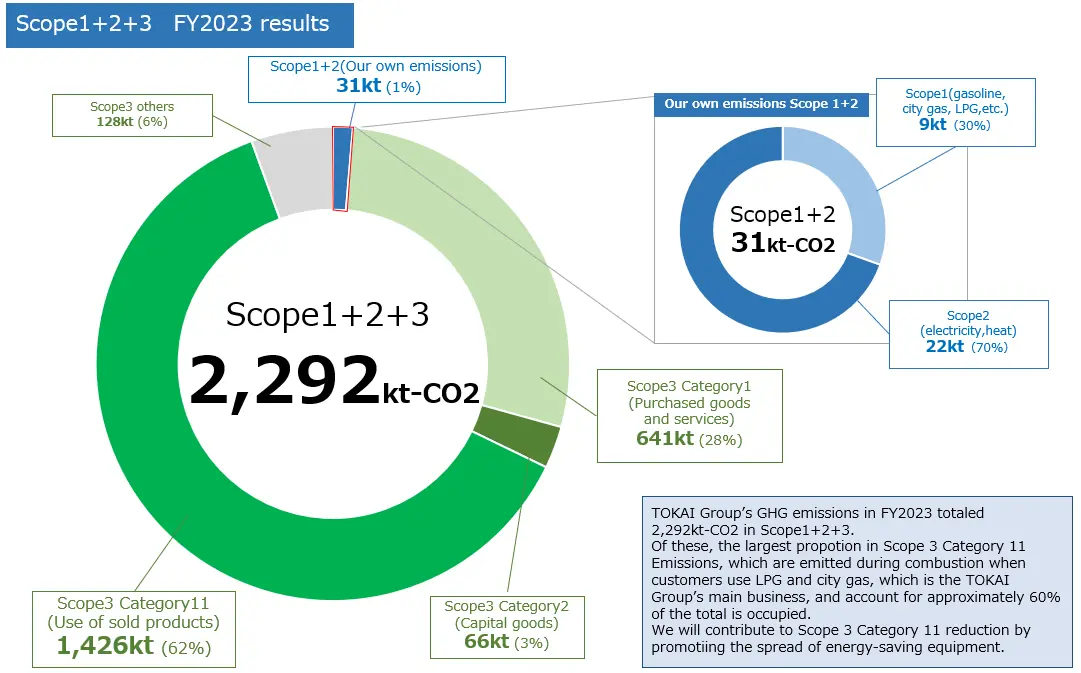

(3) The TOKAI Group's GX Promotion Measures

Based on the above analysis results, the TOKAI Group is working to reduce its own GHG emissions (Scopes 1 and 2) by installing solar panels at its own facilities, saving electricity at business sites, etc. and switching to renewable energy. We are also working to encourage customers to use energy-saving equipment and renewable energy and seeking to maintain and expand energy demand. In addition, we are endeavoring to increase our resilience by strengthening measures against wind and flood damage at our own facilities and for customers, thoroughly implementing BCP, and developing the disaster management structure.

The TOKAI Group's GX strategy for addressing climate change issues is to forge ahead with low carbon and decarbonization initiatives, striving to reduce risk while seizing opportunities for growth and translating them into business expansion.

GX Strategy set out in Medium-Term Management Plan 2025

| Measures to reduce GHG emissions (Scopes 1 and 2) from our business activities |

|

|---|---|

| Promotion of GX in customers’ energy use (Scope 3 and contribution to reduction of customers' emissions) |

|

(4) TOKAI Group GX Initiatives

The TOKAI Group has set "Strengthening the foundation for sustainable growth" as one of the key strategies in its "New Medium-Term Management Plan 2025," and is working as a unified group to reduce and decarbonize. As part of its GX strategy, the Group is promoting the two pillars of "Promoting GX in our own business activities" and "Promoting GX in customers' energy usage."

For more information, please visit this website.

3.Risk Management

We carry out an assessment and management of climate change risks and opportunities based on a yearly cycle, in principle. The GX Promotion Office of TOKAI Holdings is in charge of addressing companywide climate change risk management. The GX Promotion Office convenes the GX Promotion Committee, which is made up of Group company presidents and relevant officers, and the committee identifies, assesses and reviews climate change risks.

Group companies are instructed via the GX Promotion Committee to consider the order of priority of the climate change issues discussed at the Sustainability Committee and to take measures to address them, the progress of action taken is monitored and progress is fed back to the Sustainability Promotion Committee.

4.Metrics and Targets

The Medium-Term Management Plan 2025, announced by the Group in May 2023, positions low carbon and decarbonization initiatives as a strategy for strengthening the foundations for sustainable growth, and states that the Group will work with local communities, customers and suppliers to help reduce GHG emissions and achieve carbon neutrality by 2050.

Our metrics and targets are as follows.

| Indicater | Targets | |

|---|---|---|

| FY2030 | FY2050 | |

| Scope1+2 GHG emissions (Compared to fiscal 2021) |

At least -50% (At least -16000 tons) |

Carbon neutrality |

| Scope3 GHG emissions from supply chains |

Cooperation with supply chains | |

| Base Year FY2021 |

FY2022 | FY2023 | FY2024 | Compared to the base year | % compared to the base year | |||

|---|---|---|---|---|---|---|---|---|

| Scope1 | GHG emissions emitted directly by the company | 10.9 | 10.9 | 10.6 | 10.6 | -0.4 | -3.3% | |

| Scope2 | Indirect GHG emissions from purchased electricity, heat, etc. | 23.3 | 23.7 | 22.0 | 20.7 | -2.5 | -10.9% | |

| Scope1+2 total | 34.2 | 34.6 | 32.6 | 31.3 | -2.9 | -8.5% | ||

| Scope3 | Category1 | Purchased goods and services | 673.9 | 666.7 | 668.3 | 679.2 | +5.3 | +0.8% |

| Category2 | Capital goods | 60.9 | 59.1 | 66.9 | 65.6 | +4.7 | +7.8% | |

| Category3 | Fuel-and-energy-related activities (not included in Scope 1 or 2) |

5.5 | 5.5 | 5.4 | 5.6 | +0.1 | +1.6% | |

| Category4 | Upstream transportation and distribution | 3.9 | 3.7 | 3.7 | 3.0 | -0.9 | -22.8% | |

| Category5 | Waste generated in operations | 1.3 | 1.4 | 1.4 | 1.6 | +0.2 | +18.9% | |

| Category6 | Business travel | 1.2 | 1.7 | 1.5 | 2.2 | +1.0 | +84.5% | |

| Category7 | Employee commuting | 1.4 | 1.5 | 1.3 | 1.5 | +0.2 | +12.0% | |

| Category8 | Upstream leased assets | - | - | - | - | - | - | |

| Category9 | Downstream transportation and distribution | - | - | - | - | - | - | |

| Category10 | Processing of sold products | - | - | - | - | - | - | |

| Category11 | Use of sold products | 1,481.1 | 1,421.9 | 1,439.4 | 1,428.7 | -52.4 | -3.5% | |

| Category12 | End of life treatment of sold products | 11.6 | 11.4 | 10.5 | 11.8 | +0.2 | +1.8% | |

| Category13 | Downstream leased assets | 103.7 | 105.6 | 104.6 | 109.4 | +5.7 | +5.5% | |

| Category14 | Franchises | - | - | - | - | - | - | |

| Category15 | Investments | - | - | - | - | - | - | |

| Scope3 total | 2,344.4 | 2,278.4 | 2,303.0 | 2,308.6 | -35.8 | -1.5% | ||

| Scope1+2+3 grand total | 2,378.6 | 2,313.1 | 2,335.6 | 2,339.9 | -38.7 | -1.6% | ||

- ※We have obtained third-party assurance in accordance with the ISAE 3410 standard by the Japan Quality Assurance Organization (JQA) for 2024 GHG emissions.

In addition, due to the expansion of the boundary from fiscal year 2024, calculations for previous years are based on the same standards as fiscal year 2024. - ※Scope 2 emissions are calculated based on the Market-Based Method.

Third-party Verification

To improve the reliability of its greenhouse gas (GHG) emissions data, TOKAI Holdings has received third-party verification at the ISAE 3410 standards from Japan Quality Assurance Organization for its Scope 1, 2, and 3 actual GHG emissions.

【Verification Coverage】

■Target period and scopes

GHG emissions for FY2024

(Scope 1, Scope 2, Scope 3 Category 1, 11)

■Boundary

TOKAI Holdings Corporation and its affiliated companies, 183 locations.