Policy for Initiatives towards Implementing Management Focused on Capital Costs and Stock Prices

- Announced on May 24, 2024

Current Situation Analysis

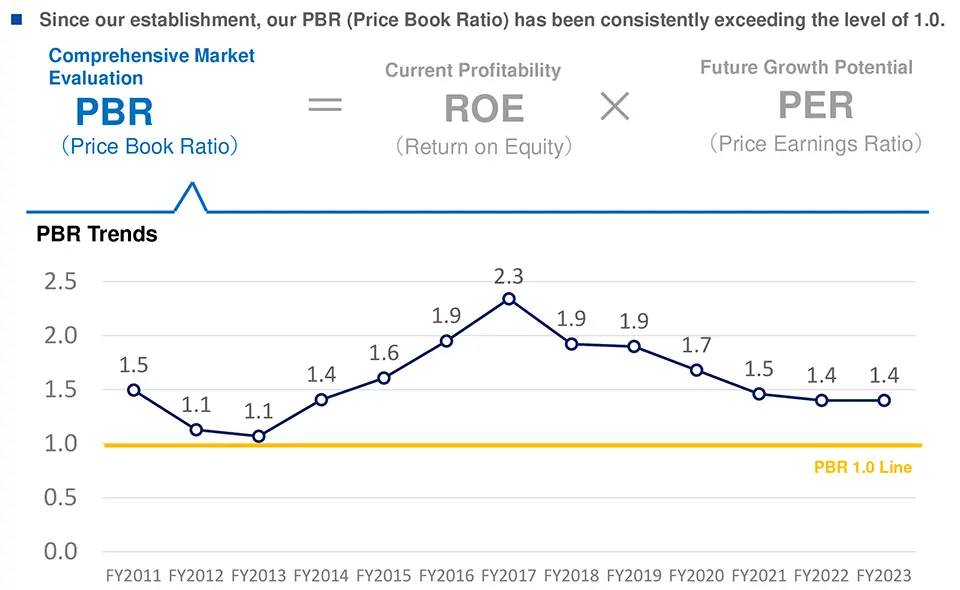

1. Trends in our Price Book Ratio (PBR)

In terms of PBR, which represents the overall market evaluation, our company has consistently maintained a level above 1 for over 10 years, reaching 1.4 in the most recent fiscal year of 2023.

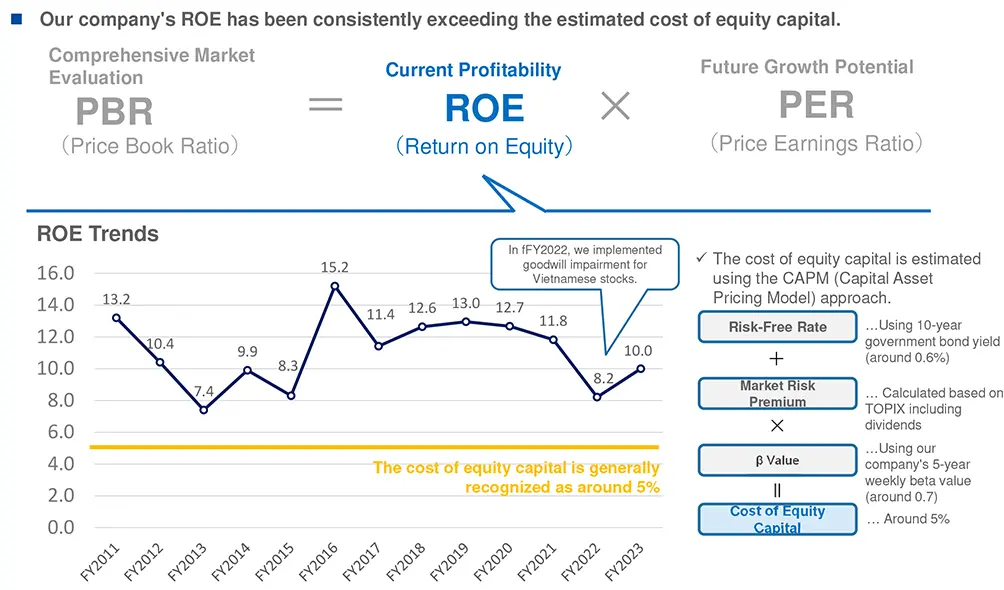

2. Trends in our Return on Equity (ROE)

The ROE, which indicates the current profitability, stands at 10% for the fiscal year 2023. Our estimated cost of equity is approximately 5%, indicating that our ROE exceeds this level.

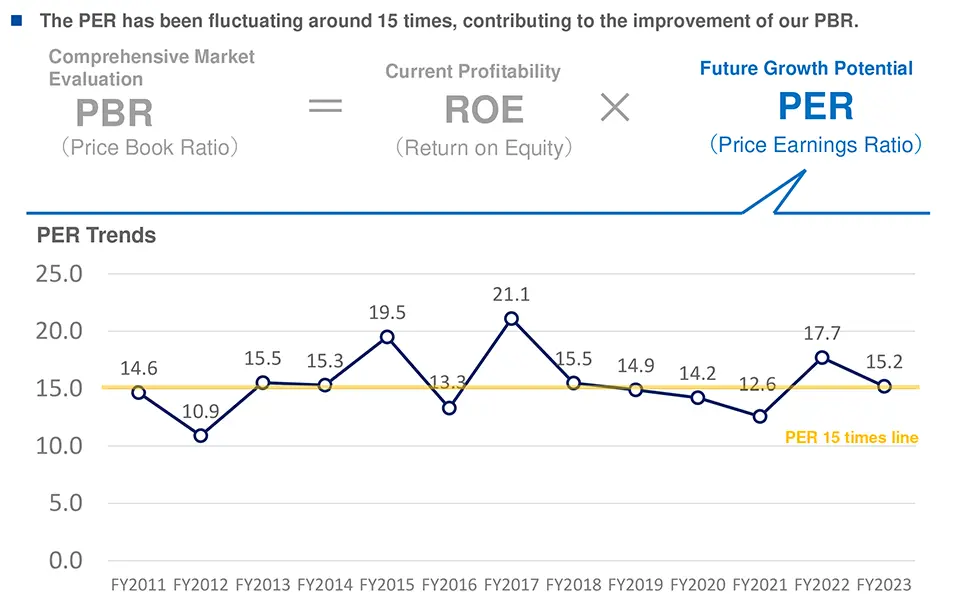

3. Trends in our Price Earnings Ratio (PER)

The PER, which reflects the growth potential for the future, has been fluctuating around 15 times, with a recent figure of 15.2 for the fiscal year 2023.

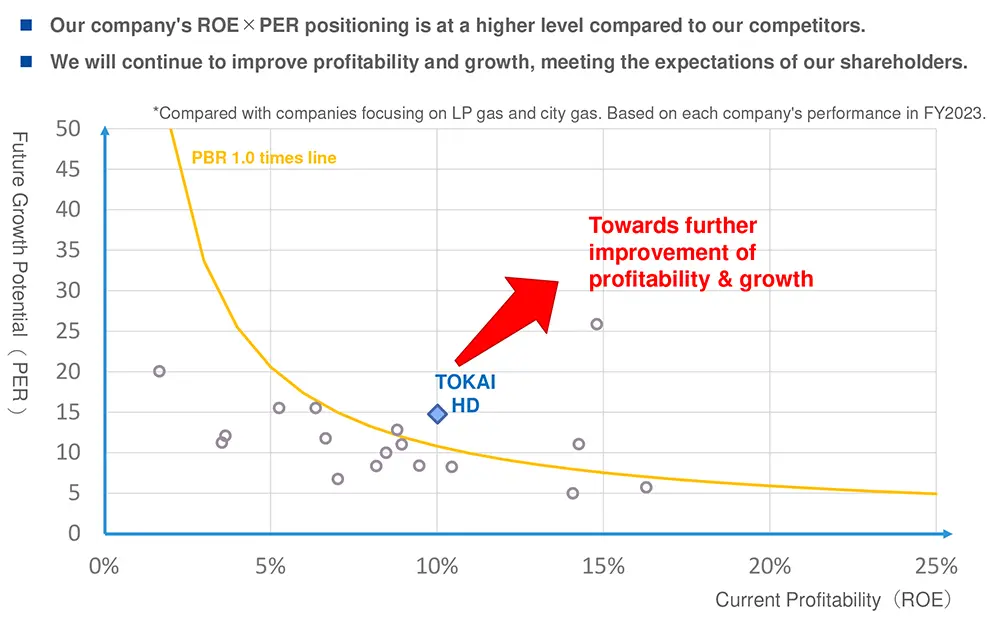

4. Our positioning compared to competitors

The chart above shows a comparison of our company's ROE and PER with other energy competitors. The horizontal axis represents ROE, the vertical axis represents PER, and the orange curve indicates the line where PBR is equal to 1.

Our company's ROE×PER positioning is at a higher level compared to our competitors. We will continue to improve profitability and growth, meeting the expectations of our shareholder.

Initiatives for Enhancing Corporate Value

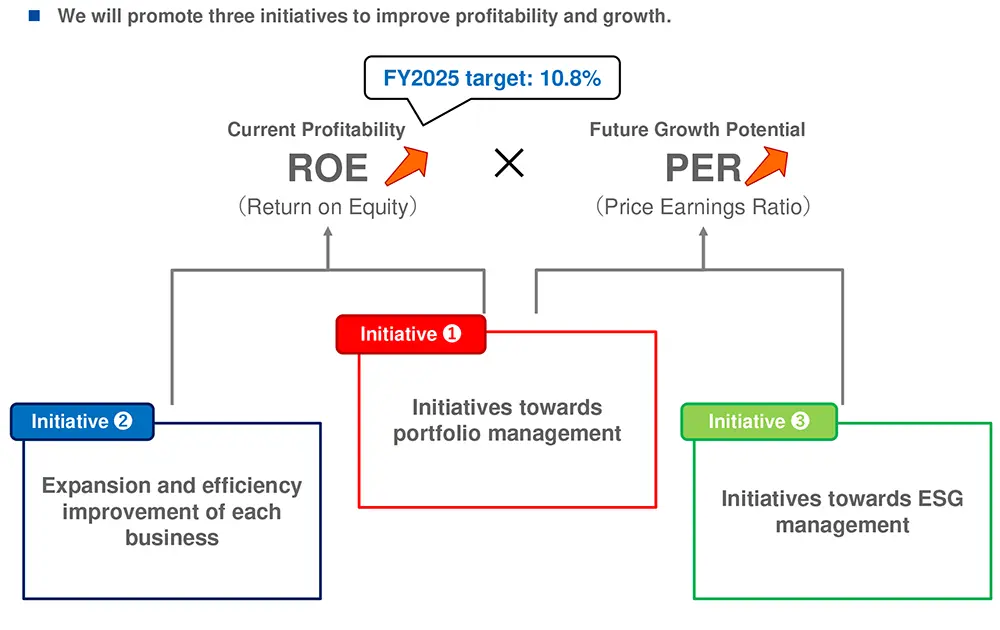

1. Overall picture of the initiatives

To enhance profitability and growth, we are implementing three initiatives. The first is "Portfolio Management," where we focus on optimizing our business portfolio. The second is "Expansion and Efficiency," where we aim to expand and streamline each business. The third is our commitment to "ESG Management." Through these initiatives, we aim to further improve our ROE, PER, and PBR. As stated in our medium-term management plan, our goal is to achieve an ROE of 10.8% by 2025.

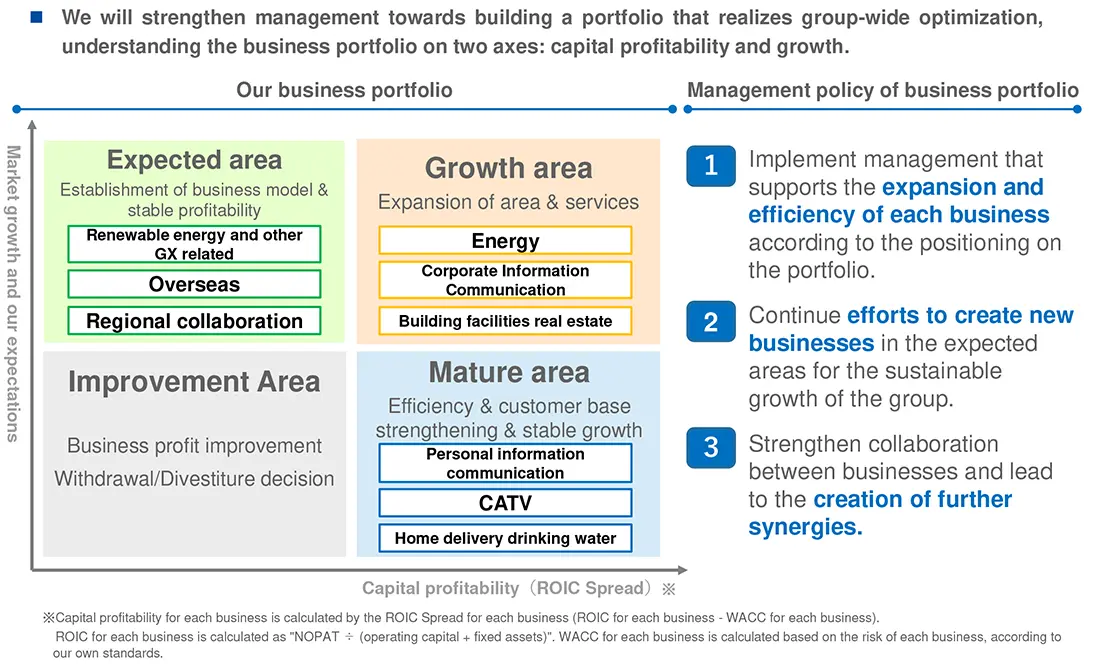

2. Initiatives towards business portfolio management

Regarding "Portfolio Management," we categorize our businesses into different areas based on their capital profitability and growth potential. In the "Growth Area," which includes energy, corporate information and communication, and building facilities real estate, we aim for further expansion through proactive investments. In the "Expected Area," which represents high-growth businesses with yet to meet a certaitn level of capital profitability, we focus on establishing business models and achieving stable profitability. The "Mature Area" consists of businesses with high capital profitability but limited growth potential, such as individual information and communication, CATV, and aqua. In these businesses, we aim to ensure stable earnings through efficiency improvements and strengthening customer bases. Additionally, for businesses falling under the "Improvement Area" with low capital profitability and growth potential, we will assess the potential for improving their profitability.

In this way, we will strengthen our management towards portfolio construction that achieves overall optimization of the group. Furthermore, we will continue to promote initiatives to create new businesses in the expectation area and to generate group synergies, aiming for sustainable growth of the group.

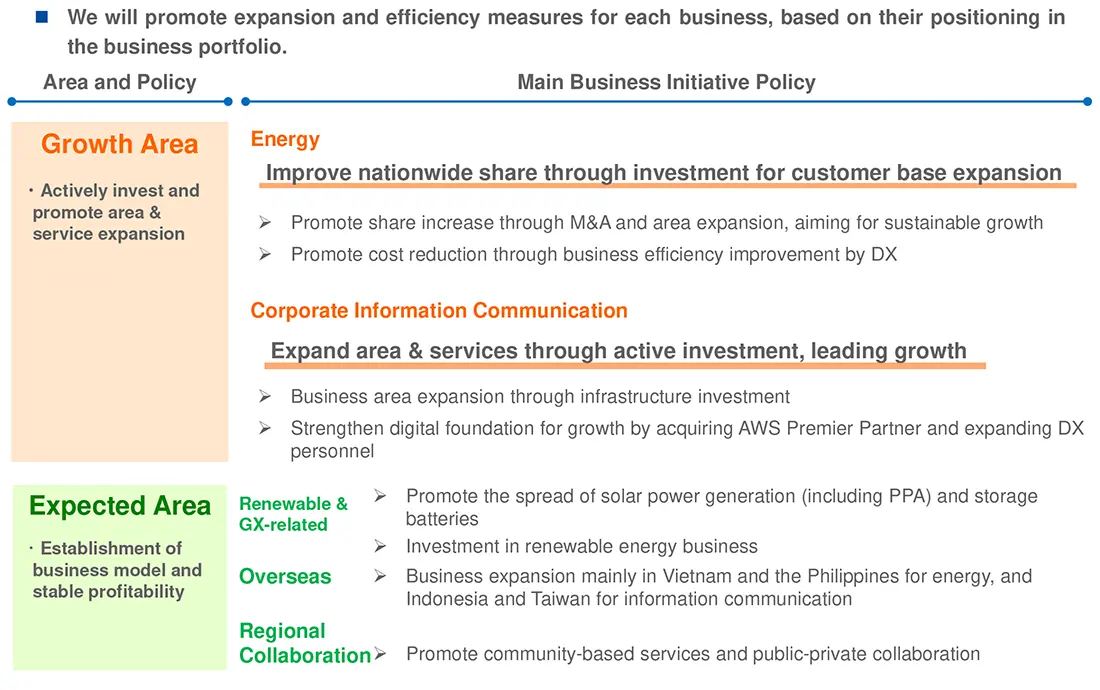

3. Promotion of expansion and efficiency in each business

Regarding "Expansion and Efficiency," we will pursue expansion and efficiency strategies tailored to each business based on their position in the portfolio.

In the energy business, positioned in the "Growth Area," we will achieve steady growth through investments aimed at expanding our customer base. In our core LP gas business, we will strive for further market share improvement through M&A and area expansion, ensuring sustained growth. We will also continue efforts to improve cost efficiency through DX initiatives.

In the corporate information and communication business, we will drive growth by expanding our business areas through proactive investments. This includes expanding our business area through infrastructure investments and strengthening our digital foundation for growth by enhancing our DX capabilities.

For businesses in the "Expected Area," we will implement specific initiatives. In the GX-related business, we will promote the widespread adoption of solar power generation and storage batteries. In our overseas business, we have expanded into Vietnam and the Philippines in the energy sector and Indonesia and Taiwan in the information and communication sector. We will continue to focus on expanding our presence internationally. In the regional collaboration business, we will promote regionally-focused services and public-private partnerships across our group companies.

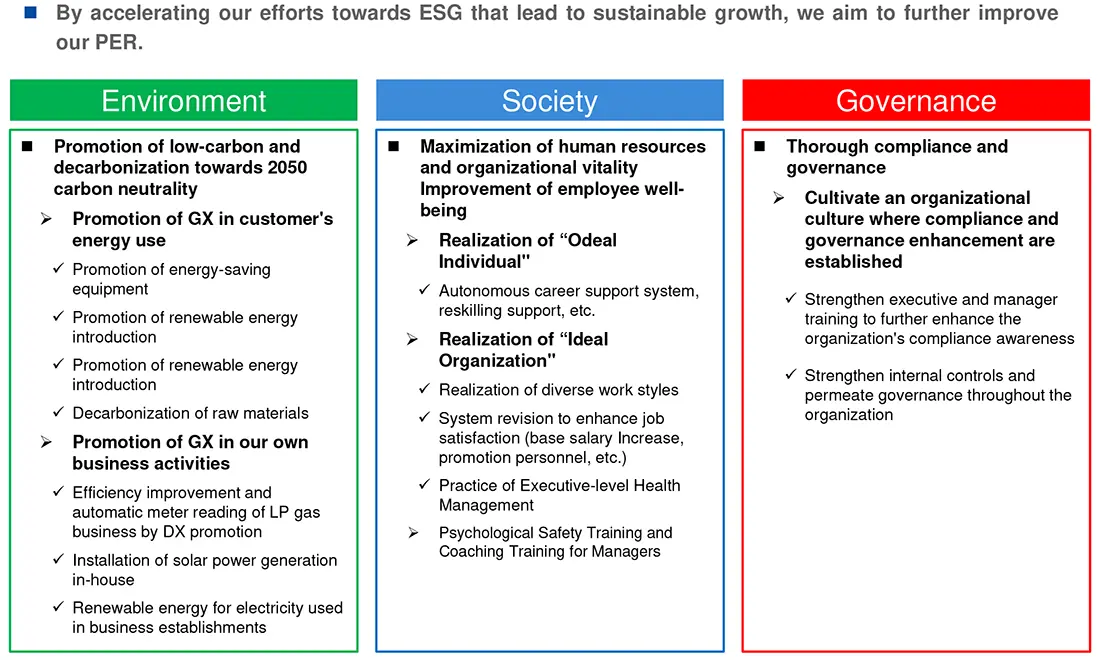

4. Initiatives towards ESG management

Regarding "ESG Management," we will accelerate initiatives in environmental, social, and governance themes that contribute to sustainable growth. In terms of the environment, we are committed to achieving carbon neutrality by 2050 through efforts in both our customers' energy usage and our own business activities. For social initiatives, we will promote measures that maximize the vitality of our people and organizations and enhance employee well-being. In terms of governance, we will strive for thorough compliance and governance. Through these initiatives, we aim to gain understanding and trust from our shareholders and investors, leading to further improvement in our PER.